Show me/Don't tell me!

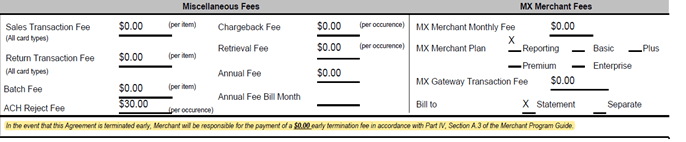

Many merchant processing companies tell you that your agreement has NO CONTRACT but after they are gone and you need to cancel, you find out that there was a Cancellation Fee! WHAT???? Yup, people lie to sell things... Merchant Processing Solutions does not! Our merchant processing agreement has it in writing that there is ZERO on the Cancellation Fee section! So no matter why you have to make the desicion to cancel your service with us, there is NO CHARGE!

Even if your representative says there is no contract cancellation fees, don't believe them! Ask to see the language verifying this information or get it in writing, from the company if that rep does not own the company, before you sign an agreement. The representative may tell you its in the Terms and Conditions section and NOT on their agreement you are signing. But by signing that Representative's Agreement for his merchant processing company, you are accepting anything that existing in the Terms and Conditions of that company! So, KNOW WHAT YOU ARE SIGNING!

Want to work with a company that offers full disclosure on pricing, rates, fees and contract terms?

Call Merchant Processing Solutions today @ 954-938-2420!