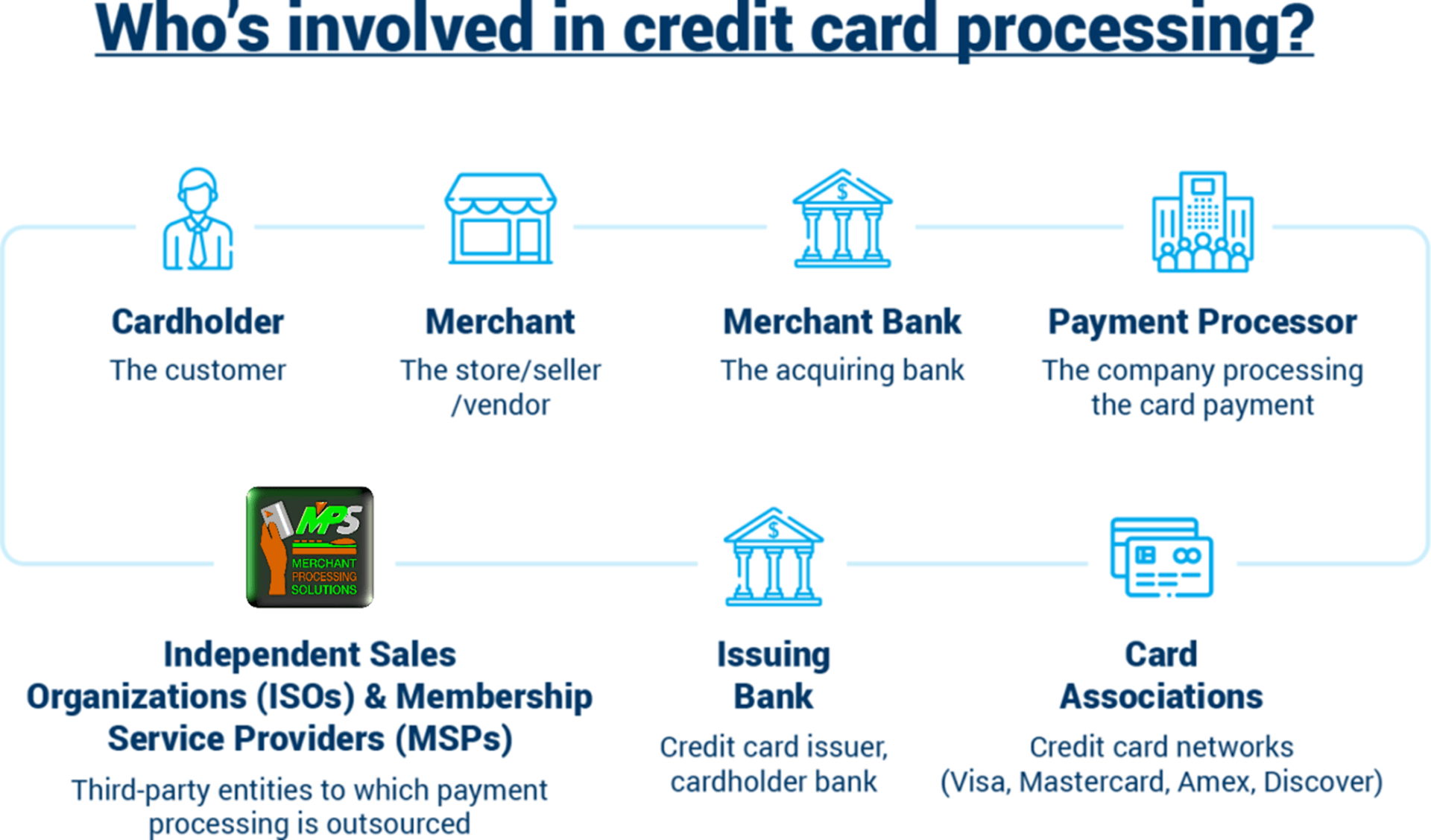

Whose involved in your credit card transactions?

Most businesses have no idea how many different entities/layers are involved in accepting credit and debit cards. In a typical transaction, as many as seven entities are involved in a single transaction, and it all happens in seconds or less.

Here is the participants involved in a typical transaction:

1. Cardholder/Customer

2. Business/YOU

3. Merchant Processing Solutions Inc /US

4. Merchant Acquirer/Platform

5. Settlement bank/Platform Sponsoring bank

6. Issuing bank/Customer's bank that provided the card to your cardholder

7. Card network/Visa, MasterCard, Discover, American Express

Once a card is swiped, the business’ point-of-sale device (terminal/card reader/POS System/Website/etc), requests an approval from the merchant processor ( Merchant Processing Solutions Inc. ).

Your merchant processor ( Merchant Processing Solutions Inc.) requests an approval from the customer’s card issuing bank (Customer's Credit Card Bank) to confirm the customer has credit available to complete the purchase via the Card Network (Visa/MasterCard/Discover/American Express).

The issuing bank then sends back an approval -- or denial -- through the credit card network to the merchant processor ( Merchant Processing Solutions Inc ).

The merchant processor ( Merchant Processing Solutions Inc.) then notifies the business electronically, via their point-of-sale device (terminal/card reader/POS System/Website/etc) , if the purchase has been approved or declined.

Finally, upon approval, the customer's credit card bank debits the customers credit card the amount of the purchase AND your Business Bank deposits the amount of the purchase into your business account.

Every step of the way, these entities are adding fees to the credit card process:

1. The Customers' banks add fees on the amount on their credit card each month

2. You bank monthly fees to have a business account open to recieve these payments

3. Merchant Processing Solutions Inc and all merchant processors charge for their part in giving your point-of-sale devices to accept credit cards and capture the data for processing and payment.

4. The Merchant Platform adds fees to get the approval for the transaction from the Customers' banks and the Card Network

5. The Settlement Bank adds a transaction fee or Authorization fee for their part in accepting payments.

6. The Customers' Banks charges interest on credit card transactions - these do not impace the rates or fees for credit card processing but this entity is making money on credit card transactions!

7. Card Networks (Visa/MasterCard/Discover/American Express) have added Assessment Fees to the cards. The average is about 18 Basis Points per transaction and sometimes more if the credit cards accepted originate offshore.

The ONLY part of this transaction that a Business Owner can control is how much they pay to the Merchant Processor ( Merchant Processing Solutions Inc . )! All other rates/fees/assessments are controled by the other entities and unless you try to sue, like Walmart did, and lost, you will have to pay all the other entity costs. However, working with the right merchant processor who will set you up correctly on the best point-of-sale for your business/industry will help you save!

Call Merchant Processing Solutions today! 954-938-2420