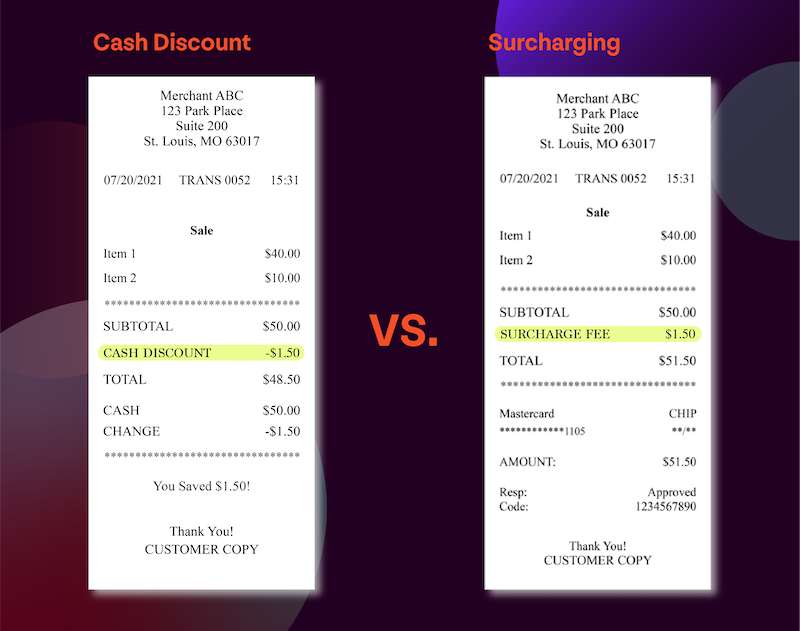

What's the difference between Surcharge and Cash Discount??

You won't need to change your shelf or menu pricing with either method! Simply offer a discount on items to your cash customers.

For most businesses, there's no harm in offering a cash discount IF you've set your prices to account for credit card purchased! This m ean you have calculated your operating costs including the fees for accepting credit cards! We find it CRAZY that businesses forget to all those costs of financing their customers meals, products or service until they can pay their credit card bill! You see if you did not take credit cards, almost half your customer would NOT be able to enjoy your restaurant, store or service!

Whether you add a surcharge or reduce the cost if paying with CASH, you're passing the credit card processing fee on to your c ustomer who enjoys the experience TODAY with the cash! No to mention points, cash back and more!

Want to know more about surcharging or cash discount? Give us a call today!

Merchant Processing Solutions Inc.

954-938-2420